What is an ESOP?

At its core, an Employee Stock Ownership Plan (ESOP) is a qualified retirement plan. The practical application of this transaction strategy is to provide an ownership transition and retirement plan for owners of privately-owned businesses.

When an ESOP is in place, an owner can sell a portion or all their shares to the ESOP at fair market value. ESOPs stand apart from other benefit plans because they allow the company to borrow money from an outside source, such as a commercial bank or private lender, in order to purchase the shares (equity) from the owner(s). This makes ESOPs a unique combination, blending a corporate finance strategy i.e.leveraged recapitalization, with a benefit plan.

The value of the plan, as an employee benefit, is directly related to the performance of the company, creating an effective incentive for management and employees to perform and be enthusiastic for successful performance results. Please note that ESOPs are mutually-exclusive to 401k plans, which can be used or continue to be provided as a benefit in conjunction with an ESOP structure.

The tax advantages that ESOPs provide a company are extensive and are covered in greater detail later in this document. ESOPs began in 1974 and have since seen an evolution in strategic application, popularity, and regulatory environment.

This document seeks to be explanatory, based upon current regulations, but should not be relied upon as a legal document.

ESOP Advantages

The advantages of an ESOP are significant, and they apply to the owners, employees, and company. Congress has encouraged employee ownership by offering unique incentives to companies that implement an ESOP. When structured correctly, ESOPs can work successfully for the selling shareholders, employee participants, and the company. The shareholders (owners) of a company can sell company stock without placing the jobs of their employees at risk, a potentially enhanced risk when selling to a third-party, and receive a Fair Market Value for their equity.

Employees earn generous retirement benefits IFthe company performs well through their holdings of the company’s stock, which is repurchased from their accounts, generally upon retirement. The company itself is eligible for major tax benefits.

Advantages in recruiting and retaining key employees:

Common to ESOP structures is the inclusion of Golden Handcuff plans for Key employees. For those employees in the leadership group of the Company on a go forward basis, a plan can be put in place for them to benefit from the value creation occurred while under their thoughtful leadership. These plans often have a longer vesting schedule to motivate employees to stay and the vesting is determined by the Board with few limitations. This is a meaningful tool for recruiting, incentivizing and retaining key personnel.

For example, if the ESOP is structured as a 100% S-Corp ESOP owned Company, the board can institute a Stock Appreciation Rights (SARs) plan whereby the Keys will directly benefit from the growth of the Company in addition to their allocated ESOP shares in the plan. The grant of the SAR to the employee would be at a value equal to or slightly greater than the per share fair market value (FMV) at the time of the grant. As time passes and the value of the Company increases the employee would benefit from the pro-rata increase of the Company value. Assume that the FMV share price is $5.00 when granted and the Key is granted 10,000 shares. Should they meet the vesting requirements, and the FMV per share price increases to $15 when their employment severs, the Key employee would receive $100,000 ($15 FMV minus $5 strike price of SAR = $10 per SAR Value times 10,000 shares).

Structuring an ESOP

ESOPs are unique in that they can be funded by loans (a leveraged ESOP)or they can be funded over time by the company’s own contributions (an unleveraged ESOP).

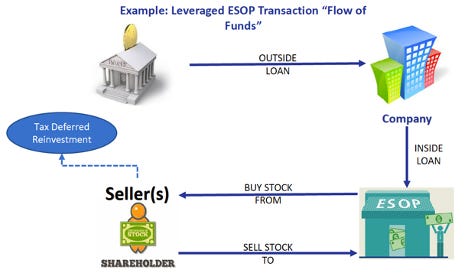

In a leveraged ESOP, the company borrows money from a bank and/or other capital provider via an “Outside Loan (bank/capital provider lends to the company),” then passes it on to the ESOP via an “Inside Loan (company lends to the ESOP).”

The ESOP then uses the proceeds of the inside loan to purchase company stock. Once the ESOP trust uses the inside loan to purchase company stock from the shareholder(s), the shares purchased are kept in a “Suspense Account.”

To repay the inside loan, the company makes annual payments to the ESOP trust that are then used to repay the loan. Because the contributions are considered tax-deductible contributions to a qualified benefit plan, the company is, in effect, repaying the loan with pre-tax dollars.

This is more relevant with a C-Corporation ESOP or a less than 100% S-Corp ESOP. With a 100% S-Corp ESOP, the business is exempt from Federal income tax as the pass-through tax entity, the ESOP trust, is exempt from Federal income tax.

As the inside loan is repaid, shares are released from the suspense account and allocated to employee accounts. In order to participate in the ESOP, an employee must generally be at least 21 years of age, have worked at least one year at the company and have contributed at least 1,000 hours of service in a year.

Tax Advantages of an ESOP

Company tax benefits are a great incentive to implement an ESOP. Here are some of the ways an ESOP provides a company with tax advantages:

When the company contributes to the ESOP annually, contributions to the plan used to repay debt are tax-deductible.

Dividend payments used to repay the ESOP debt are tax-deductible, but please note, may be subject to AMT.

Employees are exempt from paying taxes on contributions. When they leave the company, employees must pay taxes on the distribution. Employees can, however, rollover their account balances into an IRA or other retirement plan, thereby further deferring the tax liability.

Stock contributions are tax deductible. If a company decides to allocate new shares to the ESOP, it can do so without paying taxes on the value of the contribution.

In certain circumstances, capital-gains taxes on the proceeds from the sale of the company’s stock to the ESOP can be deferred or eliminated under the provisions of Section 1042 of the Internal Revenue Code.

Repayment of ESOP Loan is Tax Deductible

Company receives tax deduction for providing shareholder liquidity.

In other words, tax savings substantially increases free cash flow!

ESOPS & ERISA Law

Because they provide such extraordinary tax benefits, ESOPs must follow a myriad of strict regulations. The Employee Retirement Income Security Act of 1974, as amended (ERISA) is the law that oversees retirement plans, and it provides the guidelines that companies must fulfill for a retirement plan to qualify for certain tax benefits. If an ESOP is neither arranged correctly nor executed according to ERISA’s requirements, the company involved can incur penalties.

While ERISA’s requirements can be extensive, here is a list of core requirements for an ESOP to be considered a qualified retirement plan:

In general, every employee over 21 who has worked for at least one year and 1,000 hours within the year is eligible to be included in the plan.

Once the eligibility requirements are met, an employee must participate in the ESOP no later than the first day of the new “plan year” or within six (6) months of meeting the requirements, whichever of these two scenarios comes first. The “Plan Year” refers to the ESOP’s 12-month accounting period.

Employees subject to a collective bargaining agreement are generally excluded from participation due to the multi-employer plans to which they generally belong.

ESOP participation cannot be offered to employees who operate as independent contractors (1099 Employees).

There are additional regulations applicable to ESOPs and other qualified benefit plans, such as vesting schedule rules, etc.

Section 1042: ESOP Rollover (Equity)

Planning for the future of a business can be extremely challenging for the owner(s) of a company.

Selling to an outsider buyer is not always the best route. Even if the owner and the potential buyer settle on a valuation, there are often other significant issues to be dealt with that can impact employees’ futures. Headcount reductions are generally a major concern of employees when an ownership change occurs. Further, many privately owned businesses are based in non-metropolitan areas that could be adversely affected should a core employer be relocated or shut down following an acquisition.

To provide an incentive for owners to sell to an ESOP, and therefore preserve jobs and the economic sustainability of communities, the tax regulations provide for a deferral or elimination of capital gains taxes for C-Corporation owners selling to an ESOP.

Internal Revenue Code Section 1042 covers the ways owners can utilize a rollover feature to defer taxation, in some cases, even permanently. There are, of course, strict guidelines that must be met:

The ESOP must own at least 30% of the value of the company post-sale. This doesn’t necessarily mean that one owner must sell 30%; if two owners each sold 15% of the company’s shares to the ESOP, then they would qualify for the Section 1042 rollover benefits. The sellers, however, must have owned that stock for at least three years.

The owners must reinvest the earnings into Qualified Replacement Property “(QRP”) over a 15-month period beginning three months prior to the sale and ending twelve (12) months following the sale.

The funds rolled over into QRP (debt or equity securities of domestic operating companies) do not need to be the proceeds from the sale. They can instead be an equivalent amount of money. Additionally, the full amount does not have to be allocated to a qualified replacement property; however, the remaining sum will be subject to capital gains taxes. Many times, sellers will receive both cash and seller-debt (debt owed to the seller by the ESOP through the company) in a transaction. There are many ways a seller can maximize the tax effectiveness of the proceeds by carefully managing both 1042 tax treatment and installment sale treatment.

Valuation of an ESOP

As part of the ESOP implementation process, a company is legally obligated to undergo a valuation process through an Independent Professional retained by the ESOP trustee. As a rule, the “Independent” characteristic implies that the company has no previous relationship with the valuation consultant, as this could skew the validity of the assessment. By “Professional,” the law implies that the corporation or individual providing the valuation must routinely (annually) perform this service and must have the qualifying credentials to do so. This valuation process is critical,theESOP trust cannot pay an egregious amount over fair market value for the company’s stock, this process ensures that will be the case.

An appraiser who is both independent and professional will consider many factors when determining the value of a company. Included in this list are:

Current Profit

Projected Financial Performance (typically a 5-year forward outlook)

Expected Market Conditions

Existing Debt

Assets

Etc.

Because this is a vital step in ESOP implementation, the process is extensive and can require corporate financial records from the past five years, projected financial statements and virtually any other documentation that might impact the value of the company.

Not following the valuation procedures carefully can result in legal action against the corporation, such as lawsuits filed by the government, participants, or both.

For the determined value to be relevant, the ESOP’s purchase of shares must be performed soon after valuation.

ESOP Distributions

Employee participants in the ESOP are eligible to receive the benefits when they leave the company. The list of circumstances related to employee departures includes death, disability, retirement, and termination of employment.

The timing and amount of the payout can vary according to the circumstances of the departure.

At the time of an ESOP’s inception, the owners of the company should discuss the impact that the distribution process will have on the organization. This foresight will encourage the company to carefully plan for what is referred to as “Repurchase Liability.”

The distribution of funds in employee ESOP accounts can represent a major cash use for the company and should be planned for in advance to avoid any negative impact to the business.

For departures related to death, retirement or disability, the ESOP plan will generally start distributions during the plan year succeeding the event. However, if the participant’s employment is terminated, the company has up to six (6) years before the ESOP account is required to be distributed. In this case, the distributions can then be made over time, with the payment of reasonable interest on the undistributed balance. Payments may also be deferred should there be debt outstanding related to the funding of the ESOP transaction.

Repurchase Obligation

Once an employee leaves the company, the person is generally required to sell the stock in their ESOP account back to the company for cash. This is the “Repurchase Liability referred to earlier.”

Due to the significant impact of this Repurchase Liability, if not planned for, it is highly recommended that companies involved in an ESOP consult with an experienced advisor beforehand to discuss this topic and various ways of planning/funding the obligation.

Generally speaking, the Repurchase Obligation will increase each year after the transaction has been completed. This is a result of two factors that are occurring at the same time:

The Value of the employee’s allocated shares, and the Company equity value in total, is increasing as the bank loan and transaction financing is repaid. Most ESOPs will try and repay outstanding debt as quickly as possible and with each payment of principal the value of the Company’s equity increases proportionately.

Typical vesting schedules are 5 years. With the passage of each year the employees’ vest in more of their shares, which in turn increases the repurchase obligation.

The net result is diligently and proactively planning with your advisor team the potential repurchase obligation over an extended period. The valuation firm, in conjunction with your Pension Administrator, will provide a repurchase obligation study when requested.

ESOP Risks

ESOPs can add financial risk if not implemented carefully and with the guidance of a qualified counsel.

One of the primary costs of setting up an ESOP is the process of assembling the right team. There are costs for the company’s and shareholders’ qualified counsel, legal fees, trustee fees and fees for the trustee’s independent financial advisor who performs the upfront and annual valuations.

Leveraged ESOPs, while common, add debt to the company’s balance sheet and may have an impact on how others view the creditworthiness of the business. Because company shares are purchased with borrowed funds in a leveraged ESOP, a corporation may find it difficult to service the additional debt if business declines.

When employees leave the company for retirement or other reasons, the company generally repurchases those employees’ shares, and plans generally give the employee participants the right to do so. Like most debt-related financial decisions, this “Repurchase Liability” can be costly to a company that has not planned for it.

ESOP Associations

There are several groups nationwide that are known for their focus on and expertise in ESOPs.

The National Center for Employee Ownership (NCEO) has an extensive library of resources and literature that is available for purchase.

The ESOP Association is another membership-based group that offers educational services to its members.

Example: S-Corporation Advantages

Before the ESOP

Assumptions:

$5 Million Taxable Income

40% Tax Rate (Fed & State)

Requires $2,000,000 Tax Distribution

Shareholders Pay Tax

After the ESOP

Assumptions:

$5 Million Taxable Income

40% Tax Rate (Fed & State)

ESOP Owns 50%

For additional information and sharable resources please contact: