Partners in the Foxhole

The Right Partner for Your Entrepreneurial Clients' Exit or Recapitalization

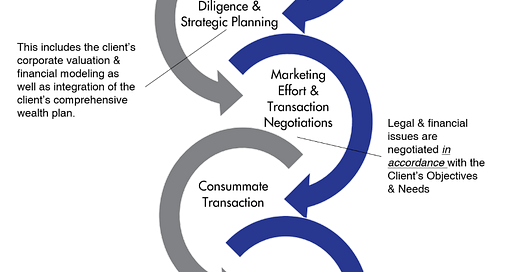

As a financial advisor, are you ever in need of a reliable Investment Banking partner that you can trust to help your entrepreneurial clients sell or recapitalize their businesses? With over 35 years of experience and a proven track record, we are experts in guiding clients through the complex process of exiting or recapitalizing their business.

Our Value Proposition to you and your clients:

Front and Center: You, their financial advisor, will be front and center throughout the entire process, ensuring that your relationship with your client remains intact and that their needs are met.

Comprehensive Support: As fellow financial advisors, we understand the importance of supporting you and your client. We ensure your seat at the table and include you in every step of the deal process, keeping you front and center throughout the entire engagement.

Non-Solicitation Agreement: You shouldn’t have to worry about your clients being poached. We understand how important your clients are to you, and we only accept IB referrals from trusted financial advisors after executing a non-solicitation agreement, ensuring that your relationship with your client remains intact.

Client-Driven Approach: We are a boutique IB firm that prioritizes your client's personal, corporate, and cultural objectives, not just the transaction. We take pride in our comprehensive discovery process.

Financial Planning: We require that a financial plan is in place based on the valuation range we provide. To that end, we will direct up to $3,000 of the client's initial retainer to you – compensation for hard work well done.

Holistic Support: In addition to the business exit or recapitalization, we assist you and your client as you navigate other financial issues before the transaction is launched, such as tax & estate planning, family office planning, and charitable giving strategies. These must be completed prior to a transaction becoming “pregnant” in the eyes of the IRS.

Transaction & Industry Agnostic: We have dealt with businesses across multiple sectors and transaction structures and have deep experience from Public Company acquirers to ESOPs and everything in between.

Funding partners: With hundreds of PE firms and family offices as funding partners, we have the connections to get your client the best possible outcome.

Middle-market Focus: Our sweet spot is lower middle-market clients with revenue between $15M-$100M and EBITDA between $2M-$15M.

Flexible Deal Size: Our minimum deal size is generally $2 million of EBITDA, but we will consider engagements with as low as $1 million of EBITDA depending on the industry and business model.

Key Differentiators:

FA-led: As financial advisors ourselves, we understand your perspective and work with you to achieve the best outcome for your client.

Team Approach: Our approach is centered around integrating the four advisory quadrants (Wealth Management, Legal, Accounting and Investment Banking) to form a high performing advisory team, working together to achieve your client's objectives. We have a saying, put enough smart people around a table and you generally come out with the best outcome.

Comprehensive Support: We aren’t competing with you for post-close assets and want you to have access to strategies that are often impacted by the IRS rules related to STEP transactions and disallowed transactions. With years of experience navigating these waters we can bring another perspective to your planning process.

When it comes to your entrepreneurial clients' business exit or recapitalization, trust RBG Capital to deliver the best possible outcome with a collaborative approach that highlights your important role in their financial journey. With our client-driven approach and comprehensive support, we are the ultimate solution for your entrepreneurial clients' financial needs.

For additional information and sharable resources please contact: